IF YOU WANT APARTMENT RENTS TO COME DOWN

YOU NEED TO BUILD - THE US EXPERIENCE

Jay Parsons

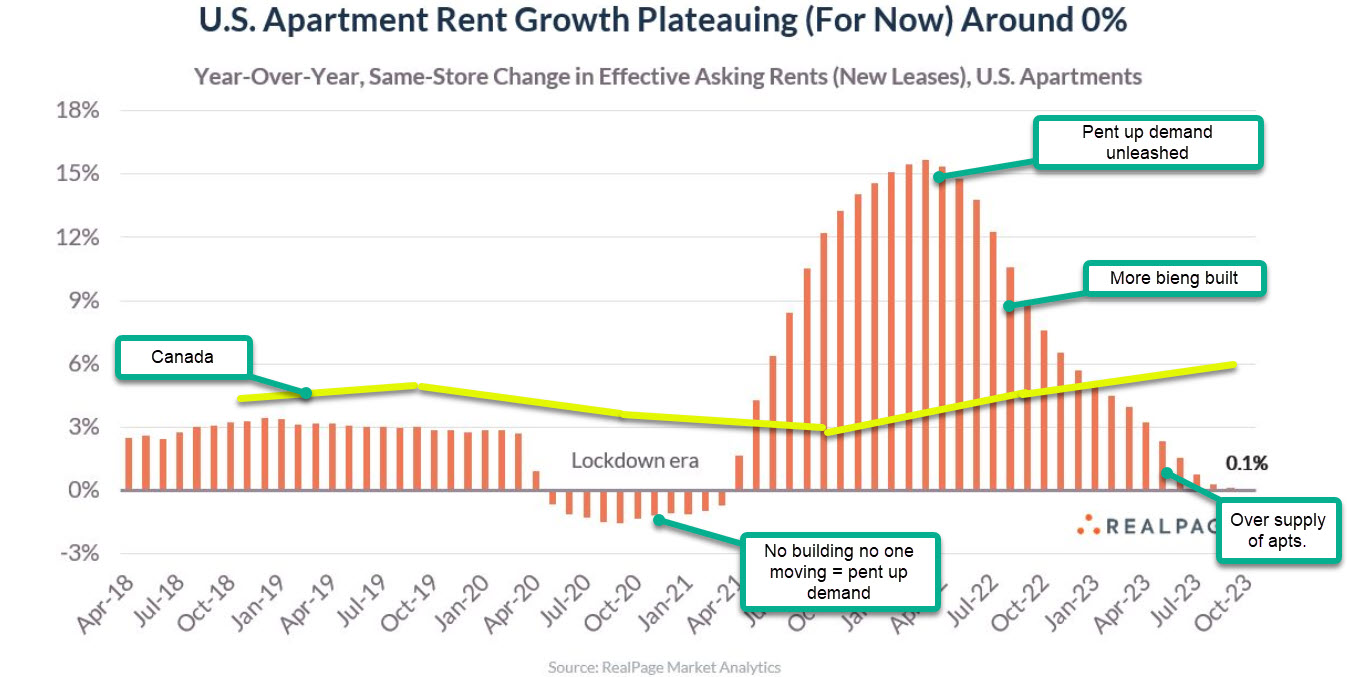

For the first time in three years, the year-over-year apartment rent growth trendline isn’t moving like a roller coaster. National rent growth held steady at a flat 0.1% annually for a second consecutive month – pushing the pause button on what had been 18 straight months of cooling that followed a similar stretch of increases.

But beneath the headline number, it’s a bit more complicated story around what’s called the base effect. Few observations on the current state and the near-term outlook for rents.

"So if you really care about affordability: Build, build, build."

1) On a month-over-month basis, effective rents fell 0.56% in October 2023. That compared to a 0.54% cut in October 2022. Those cuts rank as the deepest for any October since the Great Financial Crisis.

In other words: One deep monthly cut is replacing another in the year-over-year calculation, creating the appearance of stability in the year-over-year rent metric.

2) The base effect will remain at play through the winter due to bigger-than-normal cuts over the same period last year, which could keep the headline rent metric pretty flat. The bigger question could be what happens in the first half of 2024. At that point, the base effect is less severe at the same time new supply levels will be peaking at multi-decade highs.

3) On the plus side: October will almost certainly mark the 11th consecutive month where wage increases outpace rent increases – a trend that’ll likely persist through next year. That’ll erase much of the rent-over-wage bump of 2021 and early 2022, and in turn should help further widen the demand funnel.

As mid- and upper-income renters continue to move up from older units to newer (and typically pricier) units, the affordability gains should help backfill older, moderately priced units.

4) As a reminder: It's still all about supply. Rents are cooling fastest where supply is growing fastest. Among the markets still seeing sizable rent growth above 3%, nearly all are adding new supply at below-average rates. And among markets cutting rents the most, nearly all are adding new supply at above-average rates.

So if you really care about affordability: Build, build, build.

5) "Heads in beds" remains the industry mantra these days. My guess is we'll continue to see operators in high-supply markets (and especially high-supply submarkets) continue to cut rents to fill units.

But in lower-supply markets, it appears rent growth is leveling off and likely to remain moderately positive.

Lastly: Be leery of one-size-fits-all analysis or strategy. It's a tale of two markets right now-- those with a lot of supply and those without.

APARTMENT SUBSIDIES FOR EV CHARGING STATIONS

REMI

Multifamily landlords and condominium corporations have claimed more than a third of the funds the Canadian government has thus far allocated through its Zero Emissions Vehicle Infrastructure Program (ZEVIP) to subsidize EV chargers that are made available to multiple users. That’s largely because applicants from the multifamily sector were the most proactive among the four groups ZEVIP targeted in a effort to spur installation of 33,500 charging ports by March 31, 2026.

Newly released audit findings conclude that Natural Resources Canada (NRCan) — the federal department overseeing the program — is on track to meet that target, but could do more to reach regions and user groups where there has been less uptake. That advice is considered pertinent to NRCan’s joint mission with Canada Infrastructure Bank (CIB) to disperse funding for a further 50,000 EV chargers to be installed by March 31, 2029.

ZEVIP was announced in the 2019 federal budget, with an initial allocation of $130 million toward funding 20,000 charging ports. A further $150 million was unveiled in the 2020 fall economic statement to underwrite another 13,500 chargers. This funding has now been committed through various rounds of requests for proposals (RFPs), and 6,654 or about 20 per cent of the chargers were installed and operational when the audit was conducted at mid-year 2023.

NRCan is continuing to allocate a subsequent $500-million pot of funds announced in the 2022 federal budget. In his response to the audit, Wilkinson reports that about 45,000 charging ports have now been procured through all iterations of the program.

Project proponents can receive up to 50 per cent of the costs of installing Level 2 or Level 3 EV chargers, to a maximum of $10 million. Multifamily buildings with at least three storeys and 6,540 square feet (600 square metres) of floor area can apply for funds. Applicants directly to NRCan are asked to submit project proposals valued at a minimum of $100,000. However, ZEVIP funding is also dispersed through a number of third-party delivery organizations, which serve as aggregators of smaller projects.

As of July 2023, the audit reveals NRCan has directly channelled about 34 per cent of ZEVIP funds to multifamily buildings to subsidize installation of 11,513 charging ports. Some landlords and condo corporations may have alternatively received their ZEVIP subsidies through third-party delivery agents.

BUILDING PERMITS KEEP FALLING

StatsCan

The total monthly value of building permits in Canada decreased 6.5% in September to $11.2 billion, with most of the drop attributed to the monthly decline in the institutional component. On a constant dollar basis (2012=100), the total value of building permits was down 7.5% to $6.4 billion in September.

The total monthly value of residential permits increased 4.3% to $7.2 billion in September, led by a 37.2% monthly increase in construction intentions in British Columbia. Residential permits issued in the census metropolitan areas (CMAs) of Vancouver, Kelowna, and Victoria together made up 77.3% of the value of residential permits and 79.9% of the number of new dwellings authorized for the province in September.

The total monthly value of non-residential permits fell 21.0% from August to $4.0 billion in September. This drop was attributed to the decline in construction intentions for the institutional component (-50.7% to $1.0 billion), following a record high for the component in August ($2.1 billion) which saw permits issued for several high valued construction projects.

Despite the sharp month-over-month decline, the total value of non-residential building permits in September 2023 ($4.0 billion) was 18.7% higher than September 2022 ($3.4 billion), as construction intentions in the non-residential sector have been steadily trending upwards over the course of the past 12 months. This trend also holds true on a constant dollar basis, which removes the impact of changes in construction costs on the value of building permits.

RECENT APARTMENT SALES

Given the slowdown in the market relating to sales. We will be turning to a quarterly sales update moving forward until further notice.

THE APARTMENT GROUP

Together the team has completed over 1,500 transactions and has sold over $7.0 billion in apartments and development land. Put us to work for you and see the results. NO ONE has sold more buildings than our group. Experience, knowledge and professionalism will insure you get the right deal or the highest price if you are selling.

The Apartment Group is a dedicated team of professionals specializing in the sale of multi-residential investment properties. With over 40 years of combined experience, the team brings together their strengths including strong negotiation and sales skills along with highly technical market analysis and appraisal methods.

We are a boutique Brokerage but have the capabilities of the larger houses without the overhead. We have: an internal database of over 10,500 active apartment and land Buyers; a list of all apartment building owners in the Greater Toronto Area; our web site gets over 50,000 hits a month; we highlight properties for sale through our newsletter which reaches 10,000 investors monthly.

MITCHELL CHANG

President & Owner,

Salesperson

Direct: 416-219-0436

mchang@cfrealty.ca

LORENZO DIGIANFELICE, AACI

Broker of Record, Owner

Direct 416-417-9098

ldigianfelice@cfrealty.ca

JAKE RINGWALD

Salesperson

Direct 416-996-7713

jringwald@cfrealty.ca